50-year old way to the top

How gaming became one of the top markets

This year computer games celebrate their symbolic 50th birthday. Until 1972 computer games were academic not-for-profit productions. The first game that achieved great commercial success was Pong, released in 1972. Due to the popularity of such entertainment gaming platforms were created - slot machines and consoles, and from the 1980s also personal computers became a gaming platform. The 90s. was a further dynamic development of computer games that began to massively support online gameplay and three-dimensional graphics, becoming a mass product. The last dozen or so years have seen further polishing of sales models and the development of new platforms. Thanks to these processes, games quickly turned from trivia into one of the most profitable sectors of the entertainment industry. The most striking example of this is the largest acquisition this year - the acquisition of Activision Blizzard by Microsoft for USD 68,7 billion.

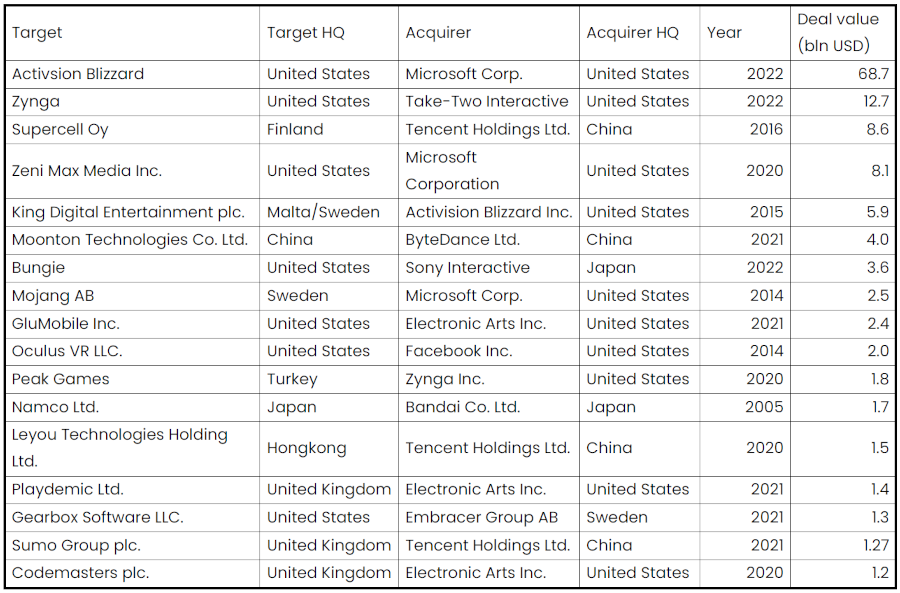

When the market started to solidify, large acquisitions appeared (the first transactions above USD 100 million are still the 20th century). But we can only talk about a real boom in recent years - most of the transactions worth over USD 1 billion were carried out in a pandemic and post-pandemic period. Large transactions on the market make it possible to wonder what factors determined them.

The table below lists the largest M&A transactions in this sector in history.

Table 1. The biggest M&A transactions in gaming sector

Reason 1. Video Games market growth

As noted in the introduction, computer games started fighting for the wallets of customers (usually younger ones) half a century ago - when the era of slot machines began with the advent of Pong. Over 50 years there have been numerous transformations, many spectacular successes and no less spectacular failures. After all these evolutions and revolutions, it can be said with certainty that computer games have become a cultural and social phenomenon that equates or surpasses the achievements and importance of other types of art. The enormous popularity of such entertainment resulted in the emergence of enormous money in the industry and the emergence of real electronic entertainment tycoons. Currently, it can be assumed that the value of the video game market is more than double that of the combined film and music market.

To understand how the gaming market works, you need to understand how developers generate revenue on their productions. The simplest division is as follows:

- Sale of game licenses (e.g. game marketplace such as Steam or Epic Games Store).

- F2P (Free-to-play) in this model the game earns by purchasing additional items by players and / or watching ads).

Usually, developers try to maximize the revenue from each player, so DLC and micropayments in paid games are now standard (DLC and micropayments themselves also have an interesting history. The first micropayment that appeared in the games is the horse armor from the Shivering Isles expansion for TES IV Oblivion. Similar solutions appeared earlier in Diablo and Baldur's Gate 2 - the difference was in the method of purchasing additional content).

The second important division is the hardware the game runs on. Here the most popular is the following division:

- Computer;

- Consoles;

- Mobile devices;

- Browse games (marginal importance. additionally its value is constanly decreasing).

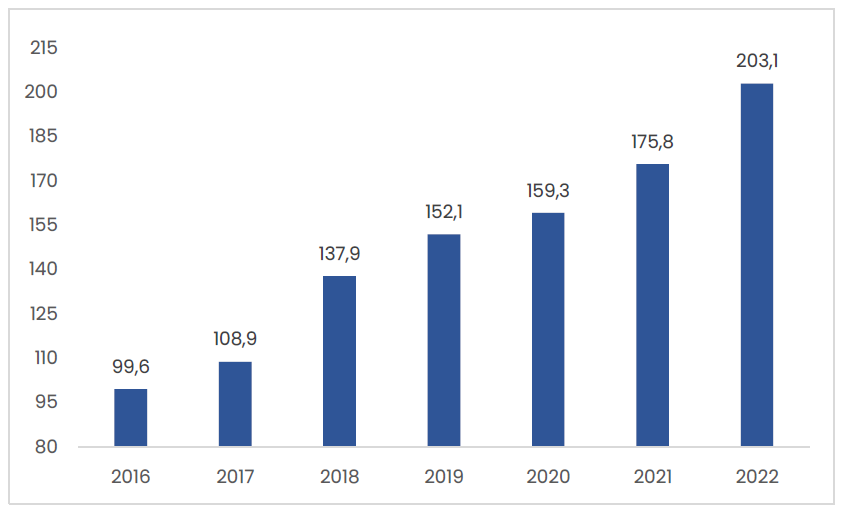

The market division presented above makes it much easier to capture the changes taking place on the gaming market in recent years. The most readable measure of the boom in the gaming industry is market growth. Information on the size of the market was taken from the reports of Newzoo - a consulting company specializing in the gaming market.

Chart 1. Market size

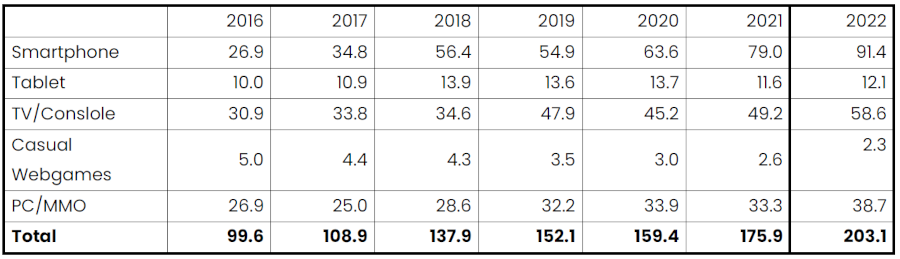

According to Newzoo reports. the value of the gaming market increased from less than USD 100 billion in 2016 to over USD 200 billion in 2021. reaching a CAGR of 12.6%. However. the growth of individual parts of the gaming market was not even. The table below shows the breakdown of the gaming market in 2016-2022.

Table 2. Breakdown of the gaming market

Mobile devices have been the driving force behind the growth of the gaming market in recent years. In 2016-2022, this market will more than 3 times grow, reaching USD 90 billion, which gives a CAGR of 22.6%. Developers of mobile games also appear in the list of the largest acquisitions (GluMobile. Playdemic), but their share is relatively small.

Another rapidly growing segment was the console market (most simply understood as: PlayStation, Xbox and Nintendo). Currently, its value is estimated at nearly USD 60 billion, reaching a CAGR of 11.3%. The key elements enabling such growth are: the exclusive release of titles (it is especially strongly visible in the PlayStation strategy) and hardware stability - the purchase of one device allows you to play a wide portfolio of games without any problems, unlike PC where the hardware requirements are constantly increasing, forcing players to to constantly improve the equipment (indirectly there were also hardware deficiencies, e.g. with the use of graphics cards for mining cryptocurrencies during the cryptocurrency boom).

The PC as a gaming platform has probably already reached its peak of popularity, but it is and will continue to be a large part of the market. In recent years, the PC / MMO gaming market has grown by an average of 6.8% annually, reaching over USD 38 billion.

Browser games have become a "victim" of the development of mobile games due to the relatively simple mechanics. In the last five years, the browser games market has shrunk by more than half, but it's still over $2 billion.

Interestingly, the largest transactions on the gaming market concerned companies producing AAA games for PC and consoles (takeover of Zeni Max, Gearbox, Codemasters and Activsion Blizzard). These entities operate in a smaller, much more capital-intensive, but therefore much more concentrated sector than the mobile gaming market. Acquisitions are the result of high entry barriers, which include: high production costs, a long and complicated process of creating a new game (both in terms of technology and creating a new brand) and difficulties in managing such projects.

Reason 2. Coronavirus time

The pandemic that started in early 2020 has not changed the world in denying it. It was no different in the gaming industry, however, unlike much of the economy, the period of the pandemic can be considered particularly successful for the industry. Unlike many other sectors of the economy that have been drastically hit by the pandemic, the video game industry has been exceptionally resilient and the specific market situation only favored it. Most video game developers and publishers could normally work in remote mode, keeping their projects developing smoothly. Thanks to this, the production process (or, if you prefer, a creative one) was not disturbed in contrast to the traditional segments of the economy. There were some problems with gaming equipment - due to interruptions in the supply chains, there were problems with the supply of equipment, but this was not so much of a problem for publishers - the games themselves are largely digitally distributed.

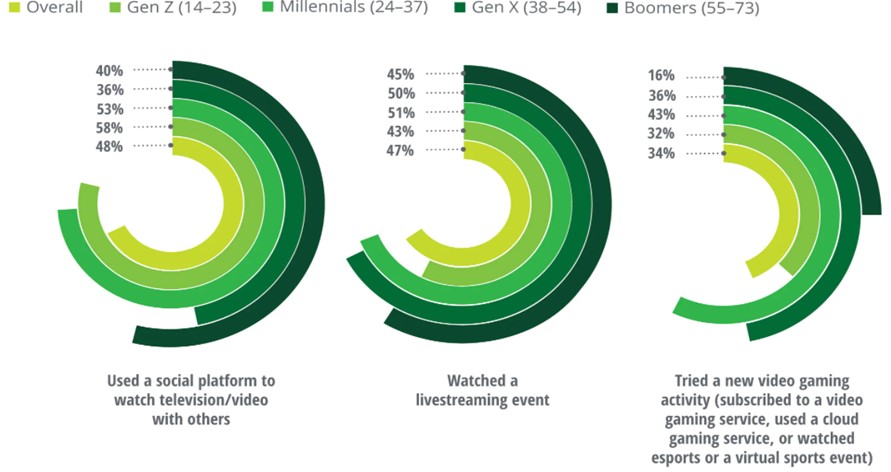

The lockdown introduced in most countries of the world in spring 2020 caused the world to slow down and people often had more free time and more worries. People also lost most of their entertainments and spent more time online. A chart from a Deloitte study allows you to estimate the scale of the increase in such activity.

Figure 1. Gaming in lockdown

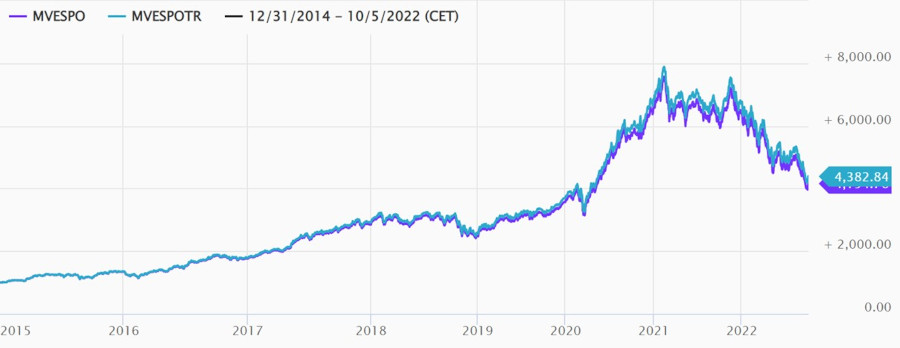

The growing interest of players in the gaming market was noticed by investors. A measure illustrating the increase in sentiment towards the gaming sector is the increase in the MVIS Global Video Gaming & eSports index. which gathers the results of the largest entities from the Gamedev sector. The MVIS Global Video Gaming & eSports index. which gathers the results of the largest entities from the Gamedev sector. may be a measure illustrating the increase in sentiment towards the gaming sector. The MVIS Global Video Gaming & eSports Index (MVESPO) tracks the performance of the largest and more liquid companies in the global video game and eSports industry. It is a modified market cap weighted index and only covers companies that generate at least 50% of their video game and / or eSports revenue such as video game development and related software / hardware. streaming services and eSports event companies. MVESPO covers at least 90% of the universe in which to invest. Gaming indices reached historically high values through 2021. The year 2022 is no longer kind to the gaming industry - game quotes have now returned to the levels from the beginning of the pandemic.

Figure 2. MVIS Global Video Gaming & eSports Index

As shown before, the gaming market has doubled in the last 6 years. The table below shows the USD-converted revenues of the largest companies in the industry. To avoid problems, the analysis below does not include highly diversified entities with significant acquisitions (eg Microsoft, which acquired ZeniMax in 2020 and Mojang AB in 2014, and the Chinese technology holding Tencent).

Reason 3: The finance of the market tycoons

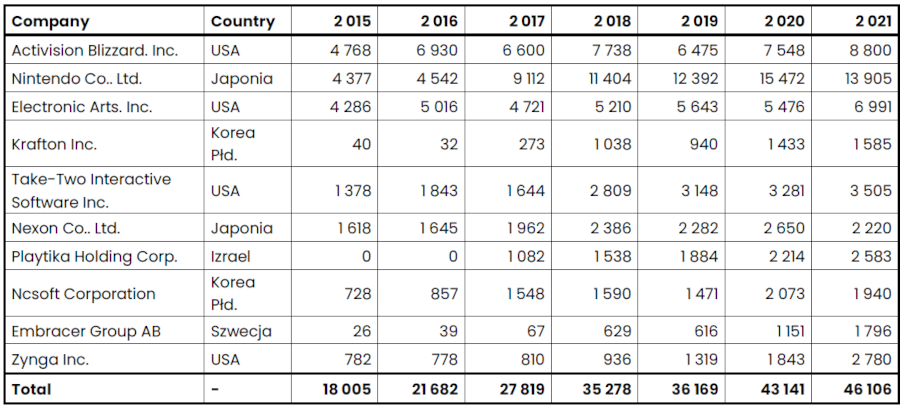

As shown before, the gaming market has doubled in value in the last 6 years. The table below shows the USD-converted revenues of the largest companies in the industry. To avoid problems, the analysis below does not include highly diversified entities with significant acquisitions (eg Microsoft, which acquired ZeniMax in 2020 and Mojang AB in 2014, and the Chinese technology holding Tencent).

Table 3. Top 10 revenue

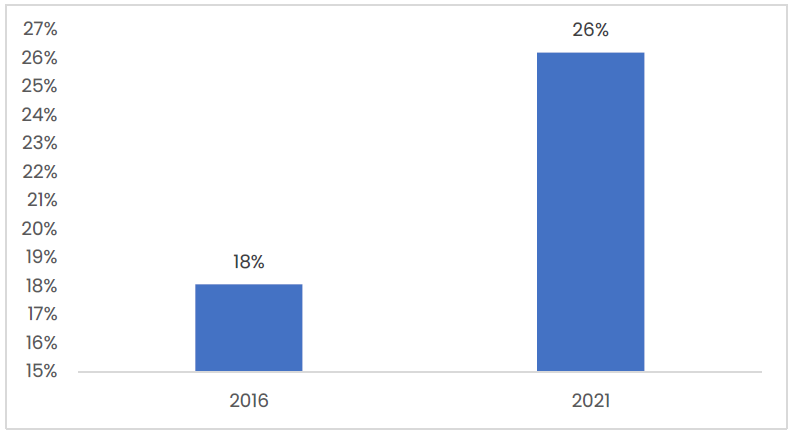

In five years, the largest listed companies operating in the gaming industry gained over 8% share in the gaming market worth over USD 170 billion. It should also be remembered that the two large entities operating in the gaming market are not on the list (Microsoft, Tencent), if we add them, it is safe to say that 12 entities control 1/3 of the computer games market, and in the area of PC and console games this indicator is much higher.

Table 4. Market concentration

In five years, the largest listed companies operating in the gaming industry gained over 8% share in the gaming market worth over USD 170 billion. It should also be remembered that the two large entities operating in the gaming market are not on the list (Microsoft, Tencent), if we add them, it is safe to say that 12 entities control 1/3 of the computer games market, and in the area of PC and console games this indicator is much higher.

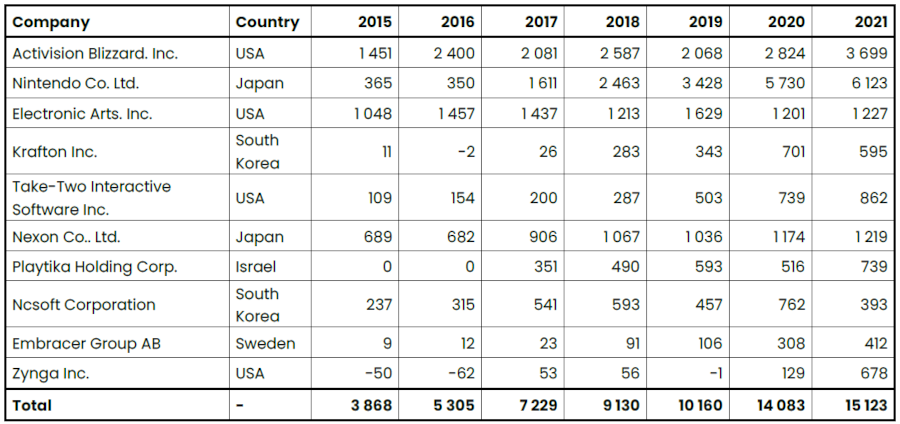

The changes taking place on the market also had a significant impact on the profitability of the gaming business. The table below presents the EBITDA (operating profit increased by depreciation) of the largest companies in 2015 – 2021

Table 5. Top 10 EBITDA

According to the accumulated data on EBITDA from the table, EBITDA in the analyzed period increased from USD 3.9 billion to USD 15.1 billion, which means a nearly four-fold increase in profit - much more than in the case of revenues. The CAGR EBITDA in the period considered was 25.5%.

The very good financial performance of the gaming industry allowed for the creation of significant cash reserves that were used to finance acquisitions - most acquisitions were financed with equity rather than through issuance. The excellent financial situation also allowed for obtaining additional capital from debt financing.

The case of the acquisition of Codemasters at the turn of 2020 and 2021 shows how fierce the competition around the acquired companies was. At the turn of 2020 and 2021, two industry giants competed to take over Codemasters, a listed game developer specializing in driving simulators. Take-Two offered to acquire Codemasters in November 2020 for approximately $ 994 million, and then Codemasters accepted the deal. However. in December 2020, Electronic Arts submitted a competitive bid worth $ 1.2 billion. 14% higher than the Take-Two offer. which the Codemasters board of directors agreed to instead. Take-Two formally withdrew its offering in January 2021. Electronics Arts fully acquired Codemasters on February 21, 2021.

Source:

- www.mvis-indices.com

- https://web.archive.org/web/20000815071957/http://www.us.infogrames.com/corporate/investor_relations/gtis/121799_gtdealclosure.asp

- https://melmagazine.com/en-us/story/et-1982-atari-game

- https://www.tomshardware.com/news/gpu-shortages-worsen-cryptocurrency-coin-miners-ethereum

- https://www.bloomberg.com/news/articles/2020-02-17/nintendo-is-likely-to-suffer-global-switch-shortages-from-virus

- https://www.videogameschronicle.com/news/ea-has-officially-completed-its-purchase-of-codemasters/