CEE Venture Capital market

Valuing startups in early rounds amid the slowing global economy

The year 2022 has been a very turbulent time for the European and global economy in many respects. Some of the biggest difficulties of recent months in the global economy include:

- An energy crisis linked to a disruption in the supply of energy raw materials. symbolised by the huge rises in the price of natural gas affecting the activities of many industrial sectors.

- High inflation unprecedented for decades due to both supply (energy commodities) and demand factors (liberal monetary policies used to pull economies out of the covidium hole).

- Supply chain problems caused mainly by lockdowns (Shanghai. for example. was closed for nearly 2½ months in spring 2022)

- Russia's invasion of Ukraine

Each of these causes independently triggered the crisis. but here we have a combination of them that has caused a series of macro-ecomonic problems that also strongly affect the global VC market.

Economic situation

VC funds invest. according to their definition. in companies that are expected to grow rapidly. so it can be assumed that a good economic situation allows for faster growth. Recent years have provided a number of negative drivers that have strongly affected the global economy and its immediate future. According to World Bank forecasts. world GDP will grow at a rate of around 3% per year. However. in the developed world. growth forecasts are much lower - in most economies. growth will hover around zero in 2023 and between 1 and 1.5 percent in 2024.

Table 1. GDP Growth

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023F | 2024F | |

| Poland | 5.1% | 4.2% | -2.5% | 6.8% | 4.0% | 0.7% | 2.6% |

| Czechia | 3.2% | 3.0% | -5.8% | 3.3% | 1.5% | 0.1% | 1.8% |

| Hungary | 5.1% | 4.6% | 2.4% | 7.1% | 4.0% | 0.1% | 2.6% |

| Estonia | 3.8% | 4.1% | -2.9% | 8.6% | -2.4% | 0.7% | 2.1% |

| Germany | 1.5% | 0.6% | 5.0% | 2.6% | 1.3% | -0.6% | 1.4% |

| France | 1.8% | 1.8% | -7.9% | 6.8% | 1.0% | 0.4% | 1.5% |

| Italy | 0.9% | 0.5% | -9.0% | 6.6% | 2.6% | 0.3% | 1.1% |

| Sweden | 2.0% | 2.0% | -2.9% | 5.1% | 2.5% | -0.6% | 0.8% |

| United Kingdom | 1.3% | 1.7% | -9.9% | 7.5% | 4.2% | 0.4% | 0.2% |

| United States | 3.0% | 2.3% | -3.4% | 5.7% | 1.9% | 0.5% | 1.0% |

| China | 6.6% | 6.0% | 2.3% | 8.1% | 4.4% | 4.6% | 4.1% |

| Global | 3.3% | 2.6% | -3.1% | 5.9% | 2.9% | 3.0% | 3.0% |

Another unexpected blow to the global economy is the unprecedented rise in inflation levels, unseen in the developed world since the oil crises of the 1970s. Average inflation in 2022 in the major economies reached levels close to 10 per cent, and even over 20 per cent in the countries of Central and Eastern Europe. According to analysts, elevated inflation will continue to consume economies in 2023 - here a major threat to economies is the 'bullwhip' phenomenon that also emerged during the 1970s crisis, a situation in which orders to suppliers are more volatile than sales to buyers, resulting in increased volatility of demand up the supply chain.

Table 2. Average inflation

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023F | 2024F | |

| Poland | 1,2% | 3,2% | 3,4% | 5,1% | 14,2% | 13,8% | 4,9% |

| Czechia | 2,0% | 3,2% | 3,2% | 3,8% | 15,0% | 9,5% | 3,5% |

| Hungary | 2,7% | 4,0% | 3,3% | 5,1% | 13,6% | 15,7% | 3,9% |

| Estonia | 3,4% | 1,8% | 0,4% | 4,7% | 19,3% | 6,6% | 2,6% |

| Germany | 1,6% | 1,5% | 0,5% | 3,1% | 7,8% | 7,5% | 2,9% |

| France | 1,6% | 1,5% | 0,5% | 1,6% | 5,2% | 4,4% | 2,2% |

| Italy | 1,1% | 0,5% | -0,1% | 1,9% | 7,9% | 6,6% | 2,3% |

| Sweden | 2,0% | 1,8% | 0,5% | 2,2% | 8,0% | 6,6% | 1,8% |

| United Kingdom | 2,0% | 1,3% | 1,0% | 2,5% | 7,8% | 9,0% | 3,7% |

| United States | 1,9% | 2,3% | 1,2% | 4,7% | 8,2% | 2,9% | 2,3% |

| China | 1,9% | 4,4% | 2,4% | 1,0% | 2,0% | 2,2% | 1,9% |

The unprecedented rise in inflation has prompted action by individual central banks, which have ended a period of expansionary monetary policy manifested in the purchase of securities (quantitative easing) and raising interest rates. The NBP, for example, raised interest rates from 0.1% to 6.75% between October 2021 and September 2022. A similar scale of increases took place in other CEE countries. The major central banks started the hike cycle slightly later - the FED started the hike cycle from March 2022 and the ECB from July 2022.

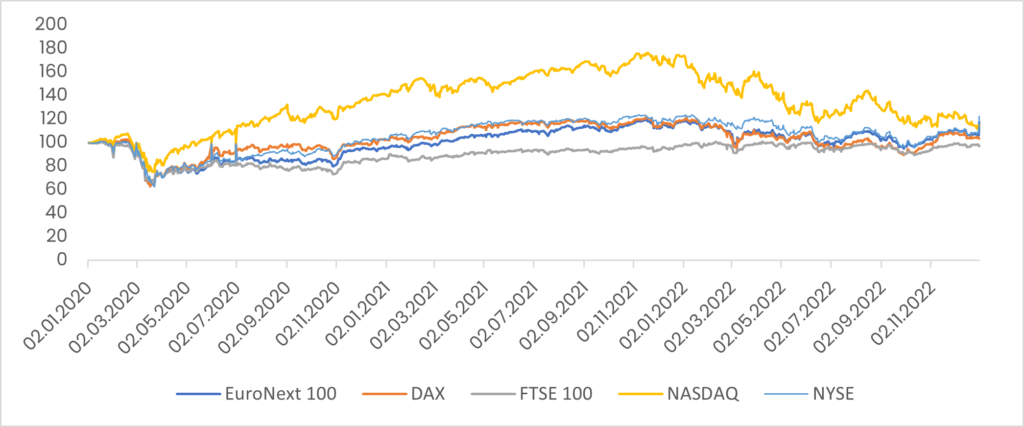

The major stock exchanges were very quick to adjust to market changes. The stock exchanges very quickly recovered from the large falls occurring during the introduction of the first lockdown in spring 2020. This was followed by a bull market pumped up by cheap money and the opportunities created by this unusual situation, particularly in the area of technology. During the covid period, there was a surge in the share prices of technology companies - the performance of the NASDAQ stock exchange was significantly better than that of other stock exchanges.

value of each index on 01.01.2020 equal to 100

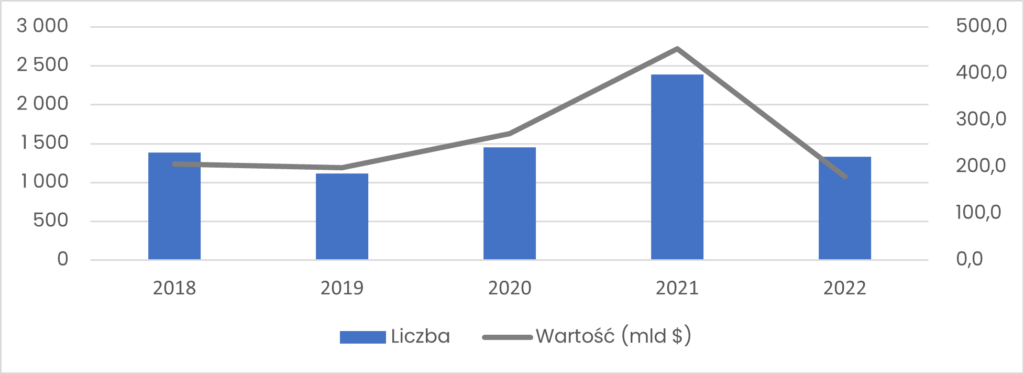

A weak stock market performance in 2022 has sharply reduced the number of IPO exits - the most calorific way to exit an investment - according to research. According to the EY IPO Global Trends report, the number of exits fell by nearly half and their value by 60%. The change was even greater in the Americas region, where there were only 130 IPOs in 2022, with a total value of just US$9bn (down 95%).

The economic situation has significantly affected the largest VC market, which is the US. Valuations and round sizes have seen a decline in 2022, particularly at stages above Series A. The value of deals at this stage fell to its lowest level in 11 quarters in the third quarter, reaching just $24.9 billion, almost $40 billion less than the quarterly peak in Q3 2021. The number of late-stage deals has also fallen significantly, by more than 20% from Q1 2022. - although it remains higher than before the COVID-19 pandemic.

VC market in CEE region

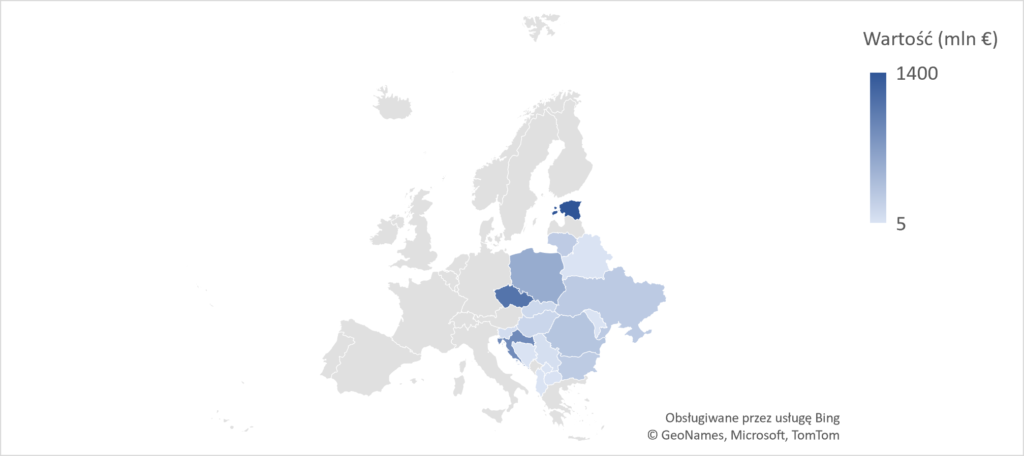

In November 2022, Dealroom and Google For Startups released a report on the VC market in the CEE region. According to the report, the CEE market is significantly smaller than other European markets. According to Dealroom, €5.3bn was invested in CEE in 2022, compared to €9bn in the Nordics and €14.7bn in the DACH region. The total value of all investments in Europe is around €90 billion, which means that the CEE region only accounts for around 6% of the market value. However, the development of the VC market in the region can be seen in the growth of investment volumes - between 2017 and 2022, the VC market grew 7.6 times in CEE, with the European market growing 3.8 times.

The year 2022 can be considered relatively successful for startups operating in the CEE region. Eight startups have appeared on the market that can be qualified to be unicorns, bringing their number to at least 44.

Investment in the CEE region in 2022 is heavily concentrated in several countries. According to the available markets, 70 per cent of all investments go to startups located in four markets - Estonia, the Czech Republic, Poland and Croatia thanks to the Rimac megaround.

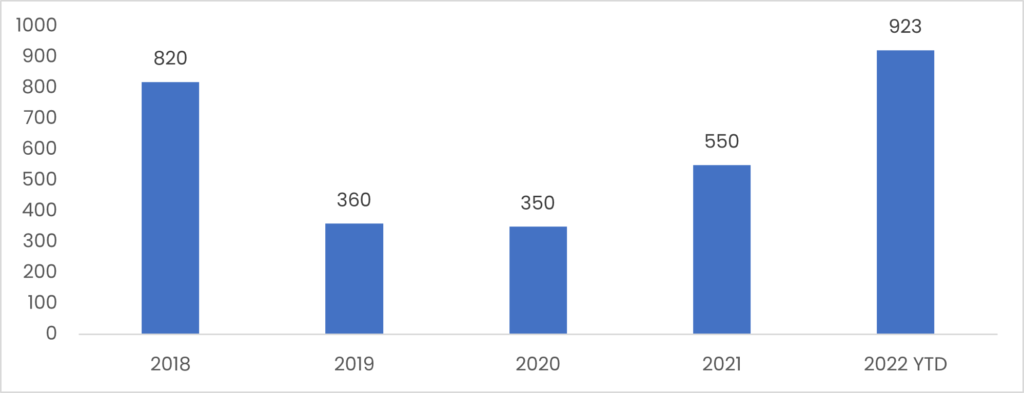

The year 2020 was a record year in terms of new fund appointments. The total capitalisation of new funds operating in the CEE region was at least over USD 900 million. The record for VC funding raised has already been broken. New funds are being established and old funds are raising new funds. The largest newly established funds from the CEE region are Lithuania's Contrarian Ventures II with a capitalisation of EUR 100 million, Poland's Inovo Ventures Fund III with a capitalisation of EUR 100 million, Market One Capital II with a capitalisation of EUR 80 million and the Czech Republic's Credo Stage IV with a capitalisation of EUR 75 million.

The CEE region has been relatively resilient to economic shocks in 2022 - this is largely due to a lower level of market development than in Western and Northern European countries and the emergence of an increasing number of investors focusing exclusively on the CEE region. According to the report, the average size of rounds involving mainly regional investors has increased compared to the previous year - for seed rounds, the average round size increased over the year from €0.8 million to €1.2 million, and for Series A from €9 million to €12.5 million. Subsequent rounds have already recorded declines - this is already linked to the global market situation.

VC market in Poland

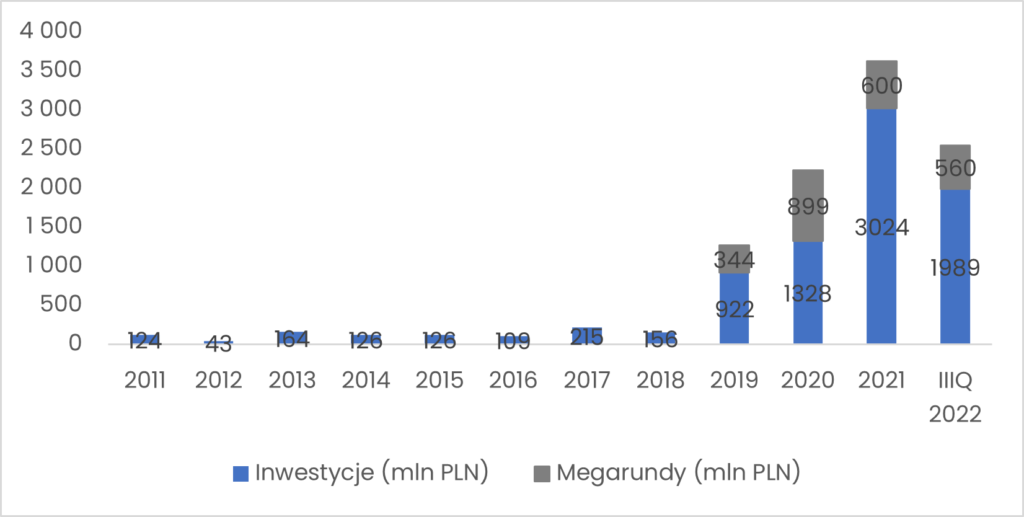

The PFR Ventures team prepares quarterly reports on the VC market in Poland. According to the data, during the three quarters of 2022, Polish startups raised PLN 2.6 billion from investors, of which PLN 560 million in Series D was raised by ICEYE operating in the SpaceTech sector.

The year 2022 is characterised by the dominance of pre-seed and seed rounds. In Q3 2022, for example, 120 such deals were completed (95% of all deals). Over recent quarters, a large decrease in the number of deals in the A and higher rounds can be observed. The decrease in the number of later rounds may be due to additional activity from international funds and a desire to focus on companies in their own portfolio. On the other hand, the confirmed turnaround in the market may have prompted startup owners who had the opportunity to do so to postpone the decision to raise a funding round for a few months.

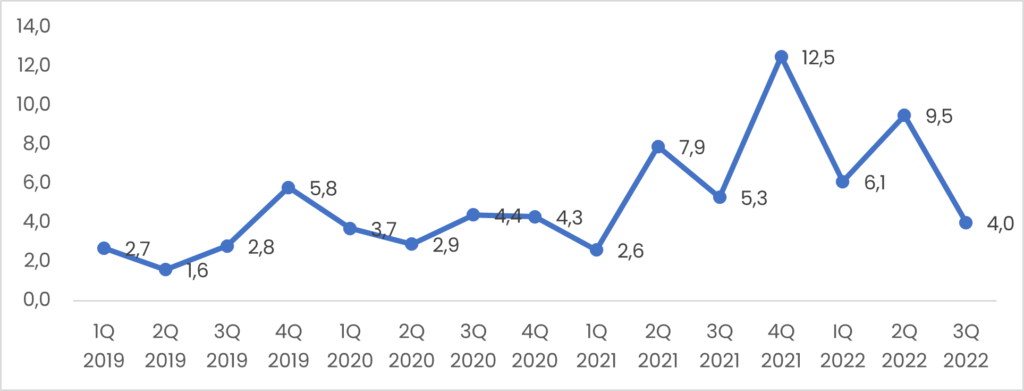

In the third quarter of 2022, the average investment ticket fell to PLN 4 million, a return to the level of 2020/2021. The median value is marked by rounds completed by funds operating in the Bridge Alpha programme, with an investment ticket of PLN 1 million. The very high number of transactions carried out by funds operating in this programme is due to the end of the investment process by these funds. Also, the withdrawal of foreign VC funds from investments due to the treatment of the CEE region and Poland as a frontier region generating additional risk - the share of funding raised from foreign investors fell from 66% to less than 30%.

Sources:

• https://economy-finance.ec.europa.eu/economic-surveillance-eu-economies_en

• https://www.macrotrends.net/

• https://tradingeconomics.com/

• https://statisticstimes.com/

• Dealroom Central and Eastern European startups 2022 report

• EY Global IPO Trends reports 2018 - 2022

• PFR Ventures reports Transactions on the Polish VC market