Decision making – part 1

Expected value and probability - why do we need mathematics in psychology...

Our adventure with decision-making begins with estimating the probability of events. Why? Because the human brain is evolutionarily prepared to think in terms of expected value. Hence, subjective probability estimation plays a huge role in decision making (remember, the "computer" in our brain is constantly calculating the expected value, i.e., performing multiplication by the % of probability of an event!). The problem is that people like to express probability intuitively which is very imprecise. Want to see how this works? I invite you to take a short quiz (you can find the correct answers at the end of the text):

A: Lidia is a 31-year-old single, open-minded, and very bright person. Some time ago she graduated from philosophy studies. As a student, she was actively interested in social problems and participated in demonstrations against the creation of nuclear weapons. Which of the following statements seems most likely to you:

- Lidia is a librarian

- Lidia is a librarian and is active in an environmental club

- Lidia works at a bank.

B. Which is the more likely cause of a person's death?

- Being attacked by a shark while swimming in the ocean

- Being hit by debris falling from some plane.

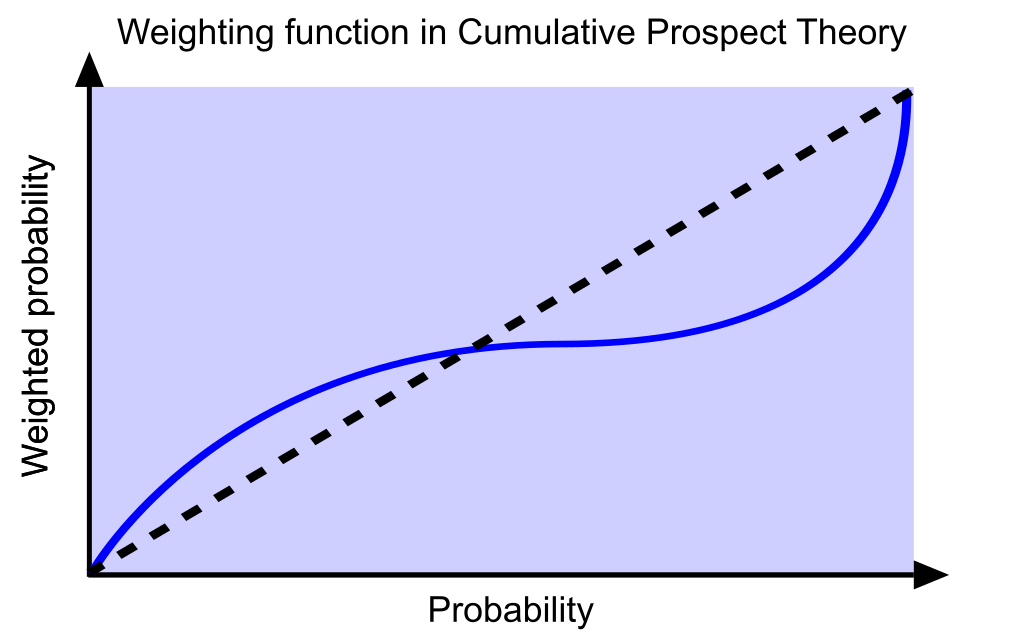

Numerous neuroscience studies confirm that we have a computer built into our heads that automatically recognizes which decision in economic terms is best for us. And - as it is with the computer - what data comes in, is what comes out; and I'm thinking here of the fact that we often provide our brains with statistically false data, filtered by our experiences and contaminated by emotions. But... we will talk about emotions in the next parts, today about one more important specificity of our "computer". The research of two psychologists, Kahneman and Tversky, proved that we tend to overestimate small probabilities and underestimate large ones (see the graph). People overestimate the small chance of winning a big prize as well as the small chance of a very big loss occurring. The entire gambling market is based on the former, and insurance is based on the latter. But about this, we shall not talk today!

On the other hand, the mentioned gentlemen Kahneman and Tversky became famous in 1979 with one of the most important works in the field of economic psychology, namely the Prospect Theory. They became so famous that Kahneman won the Nobel Prize in 2002 (Tversky, unfortunately, died a year earlier). In the next episode, you'll learn how we make decisions in the context of profit and loss and what it means to us in everyday life. See you there!

Quiz answers

A3; you can't see a direct correlation between Lidia's competence and statements 1,2,3; hence you have to approach the problem from the other side, i.e. asking the question, are there more women working in banks or in libraries? not to mention environmental activists working in libraries

B2; cases of death due to being hit by waste thrown out of an airplane - unlike shark attacks - are not publicized by the media, while in fact dozens of them are recorded every year, the latter at most a few.