Three most popular exit strategies

Goals and drivers determining deals

One of VC market’s distinguishing features is its great optimism – and rightly so. Once a funding decision is reached, portfolio companies are generating no or very little revenues; and in a few years' time they are to become large, respectable enterprises generating value for their clients. Bear in mind, however, that VCs operate for the sole purpose of generating a return on investment by way of a successful exit. These, in turn, come in many different shapes and forms. The three most popular are: sale to an industry investor, sale to private equity, and going public (IPO). Exits differ depending on what option you go for:

- Strategic investors, quite understandably, view their investment as crucial and characterized by a long – often unlimited – time horizon. Such investments enable the introduction of a genuine development strategy. Strategic investors usually acquire a share large enough to enable them to take control and influence company management. Investors of that ilk oftentimes are in a similar business to that of the acquired company. Increase in the value of assets purchased by strategic investors is often due to costs optimization (e.g. cuts in marketing or operational costs) and greater growth potential (acquisition of technology, qualified employees, clients, etc.). This type of investors is most often comprised of companies from a similar industry, capital groups, but also groups of managers involved in management buyouts.

- Private equity invests money in company stocks or equities with the aim of achieving above-average medium to long-term returns. Profits come from the increase in the company value and the payment of dividends. Private equity generally aims to invest in companies with an established market standing that look for extra capital in order to expand their business. Usually, investors of that type have a time horizon of 3 to 7 years – they look to divest after that time is up.

- Initial Public Offering (IPO) is the process of offering shares of a private corporation in a new stock issuance for the first time, i.e. going public. IPO enables a company to obtain capital from public investors. The transition from a private to a public company is a significant moment for private equity investors, as it represents a moment to fully realize their return on investments – this is so as it typically includes an issuance premium for current private equity investors. At the same time, it also enables public investors to participate in the offering.

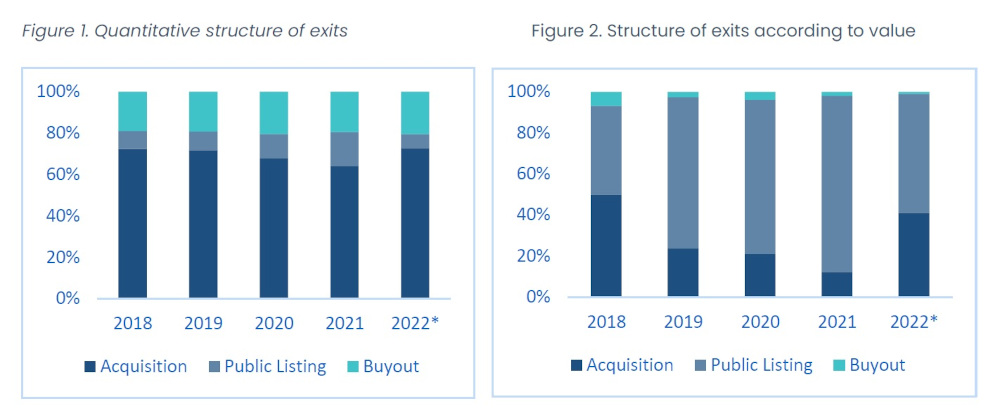

IPO of a portfolio company is both the most desirable and the rarest exit method. According to the Q2 2022 PitchBook-NVCA Venture Monitor report which follows the US VC market, IPOs are responsible for the majority of exits value-wise, but their number is actually relatively small. The most common type of exit is an industry investor takeover, which is the case for approx. 2/3 of all deals.

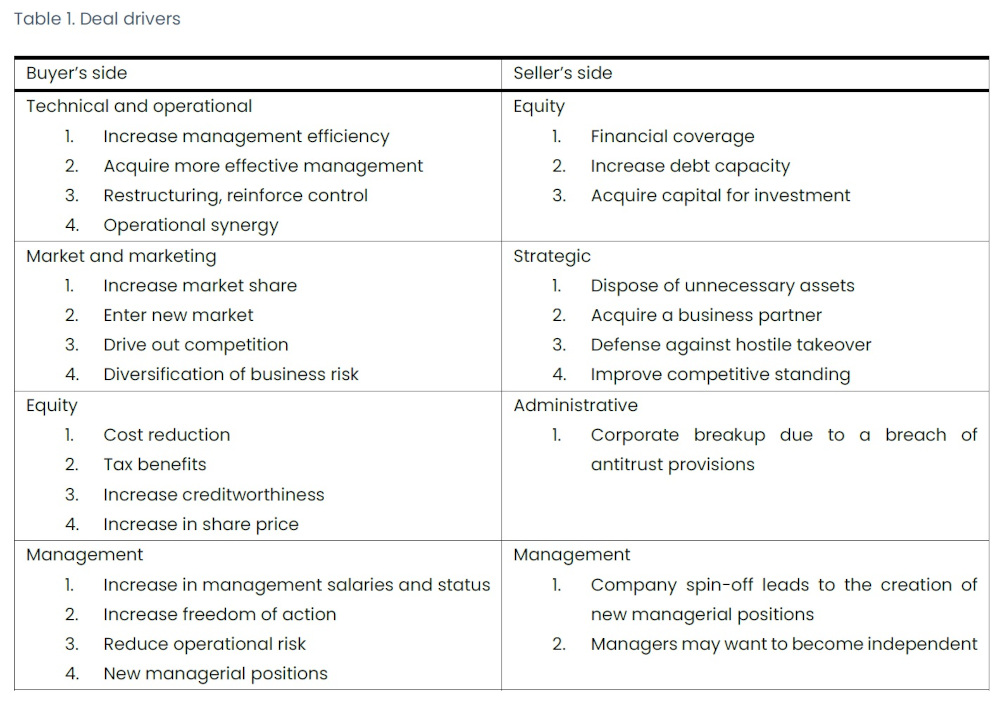

Deal drivers can be determined on the part of the buying company as well as the selling company. Mergers and acquisitions are rooted in economic and non-economic reasons. The table below shows M&A drivers on both sides of the deal.

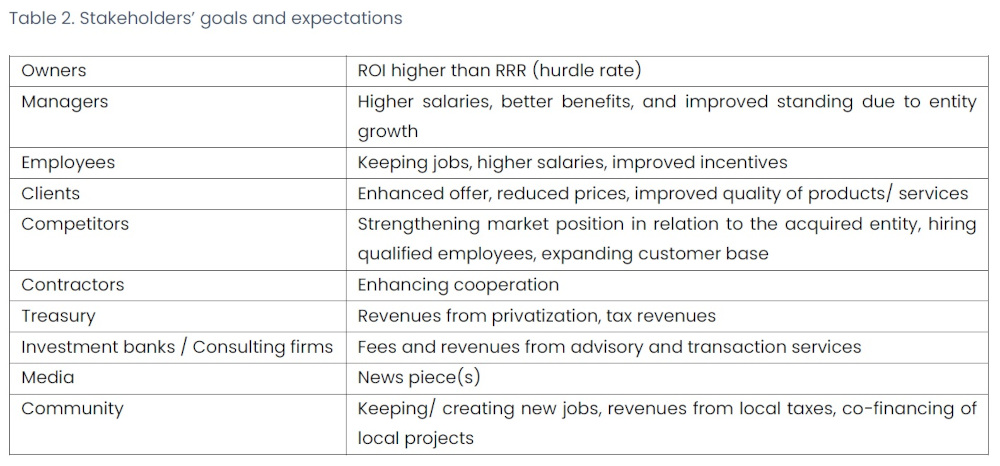

If the table above suggests one thing, then it’s that mergers and acquisitions take place for a whole variety of reasons which are often interconnected and thus make it difficult to pinpoint a single key element driving deals to completion. According to the behavioral entrepreneurship theory, an entity has a broader scope of activities than simply maximizing enterprise value – therefore, for a deal to be completed, it is necessary to take into account the interests of all stakeholders. The table below shows the drivers behind stakeholders' actions.

Sources:

- E. Ambukita, Fuzje i przyjęcia jako strategia rozwoju przedsiębiorstwa – aspekty teoretyczne,

- A. Damodaran, Finanse korporacyjne, teoria i praktyka

- P.A. Gaughan, Mergers, acquisitions and Corporate restructurings

- Z. Korzeb, Teoria kreowania wartości dla akcjonariuszy w procesach fuzji i przejęć w polskim sektorze bankowym

- Pitchbook NVCA Monitor Q2 2022.

- www.psik.org.pl